State Bank of India (SBI), being the biggest state-run bank in the country, has come out with a special savings scheme for the small investor. Titled as SBI Lakhpati Scheme 2025, it assists a person in realizing their dreams of become a lakhpati with simple monthly savings. By depositing just Rs 1500 every month, investors get Rs 1 lakh at maturity.

What Is the SBI Lakhpati Scheme?

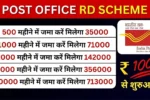

The SBI Lakhpati Scheme is a recurring deposit plan in which an investor deposits a certain sum for a sum period every month. At maturity, the investor receives interest plus the deposited amount, thereby enabling the safest and the systematic means of creating wealth.

Working of the Scheme

Depositing Rs 1500 monthly in this scheme helps a person to more or less realize Rs 1 lakh at maturity, including the interest. The exact maturity amount is subject to the interest rate at the time of opening the account.

Benefits of the Scheme

The scheme is completely risk-free, as it is backed by SBI. It supports small investors to save little by little and amass a large amount. Interest is compounded quarterly, thereby providing returns. It is great for students, salaried employees, and small business owners who want to save without taking any risk.

How to Open the Account

You can open a Lakhpati Scheme account at any SBI branch, through internet banking, or by using the SBI YONO app. The customer should complete his/her KYC and make the first installment as the starting of an account.

Conclusion

The SB Lakhpati Scheme 2025 is a simple but very effective savings plan for those who aspire to make disciplined monthly deposits toward the milestone of Rs 1 lakh. With just Rs 1500 as a monthly deposit, an investor can secure his future without worrying about market risks.