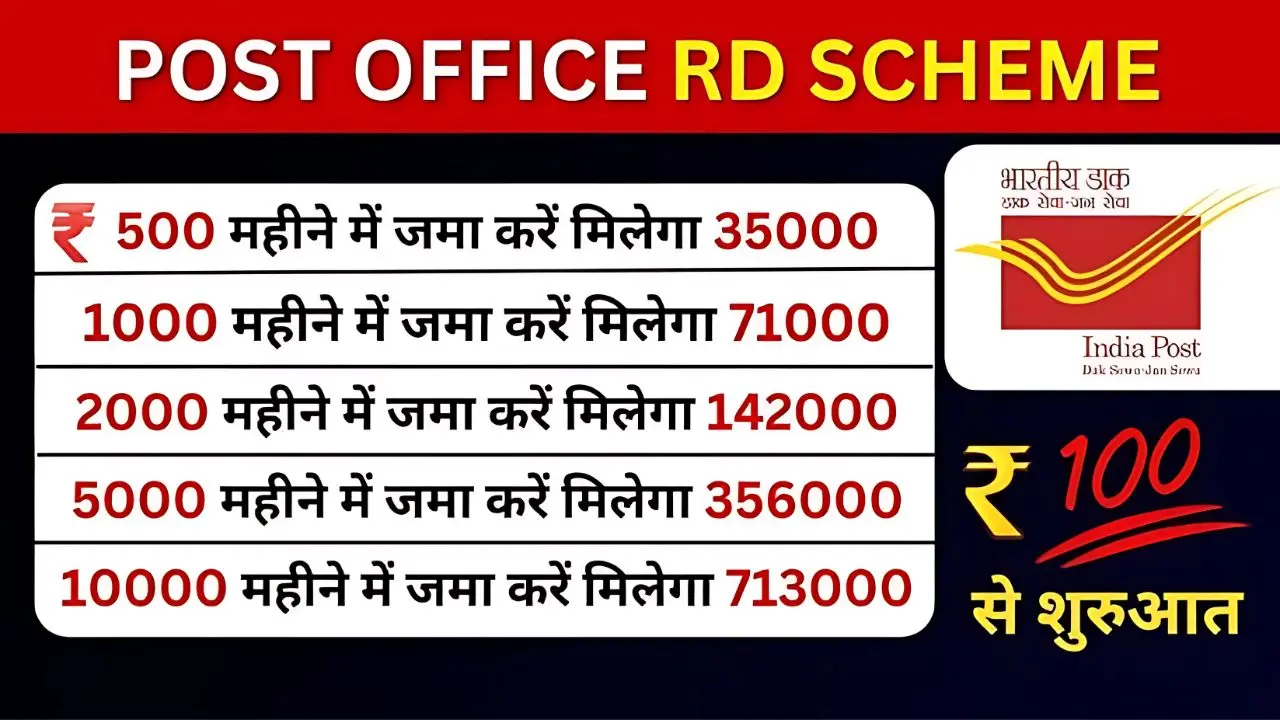

For someone who wants to grow money safely, the post office savings schemes top the chart as the best options, with Post Office RD being the most popular one, as it works on small monthly deposits that accumulate into a lump sum after some years. With proper and regular saving habits, even an amount as small as ₹10,000 can become an astronomical ₹7.13 lakh due to the magic of compound interest.

What is a Post Office RD Scheme?

Post Office Recurring Deposit scheme is a government-backed savings scheme where one deposits a fixed amount every month. It is for the people who like to save regular amounts and are happy with assured returns for their money. Since the government backs the scheme, it assures complete safety and a steady growth of returns.

How ₹10,000 Becomes ₹7.13 Lakh?

If one deposits an amount of ₹10,000 every month in a Post Office RD, for a long period, the investor thereby gains implanting interest. So over and beyond this maturity period, such a deposited amount cum interest gets to build an amount of as large as ₹7.13 lakh. This makes RD scheme one of the best and a very reliable way to build wealth without high risk.

Salient Features of Post Office RD

- Government schemes assure 100% safety.

- Interest rates are attractive and guaranteed.

- Flexible tenure for the achievement of financial objectives.

- Premature withdrawal option in special cases.

- Easy to open and conduct all operations across any post office throughout India.

Eligibility and Rules

- Any Indian citizen can open this account.

- The parents can also open accounts in the names of their kids.

- Minimum deposit starts as low as ₹100 every month.

- There is no maximum limit so as to comfortably invest higher monthly amounts.

Why Post Office RD Strongly Suggests Itself in Wealth Building?

The Post Office RD is apt for salaried persons, small entrepreneurs, and families looking to save without an iota of risk. By saving regularly with a small monthly deposit, this becomes a big sum after several years, sometimes meant for out-of-pocket payments for education, marriage, or any other long-term financial objectives.

Conclusion

The Post Office RD scheme justifies that small savings can yield big returns. When one goes on investing ₹10,000 every month, one converts a disciplined habit into a guaranteed fund of ₹7.13 lakh. Due to guaranteed safety and assured returns, it is one of the most trusted small saving options for Indian families.